After tentatively stabilizing in September, the gold price staged a $50/oz, rebound in early October, setting up the potential for a further short covering rally.

Gold traded higher on Friday and is heading for the third straight weekly increase on the back of a rise of demand due to equity market volatility and a softer dollar. The market opened the day at 1229.70/1230.70. After the open, gold prices traded between a high level of 1230.46/1231.46

The gold in euro terms was trading at a three-month high near €1,070 per troy ounce. The conflict between Italy and the EU [European Union] over the Italian draft budget for 2019 is escalating.

The EU too seems to be taking a strong line against member states (Poland and Hungary are examples) which diverge politically from the consensus policies and rules. There is perhaps a fear here that the EU might break up if too many member states fall out with the EU hierarchy, which is probably why such a hard line is being taken on Brexit. A consensus deal is in both sides’ interests, but intransigence may well win the day, with adverse economic consequences for the U.K. and the EU as a whole.

Concerns that the euro-zone crisis could flare up again should support demand for gold as a safe haven.

Lately, US have been very aggressive in its trade policies and imposition of sanctions against countries like Russia and China. Indirectly the other counties that wish to trade with these sanctions hit economies will also suffer in the long run. They too will become victims of U.S. trade sanctions and imposed tariffs.

This is the main reason that countries like Russia and China have accelerated their gold reserves. Leading countries are trying to reduce dollar dependency, thus replacing it with gold.

The Russian central bank has announced yet another increase in its gold reserves in September – this time it has added a massive 1.2 million troy ounces (37.3 tonnes) to the gold in its Forex holdings. This brings the overall total to 65.5 million ounces (2,037.3 tonnes) and means it has added just short of 200 tonnes of gold to its reserves in the first 9 months of the current year which represents an increased acceleration in its reserve increases over the prior few years

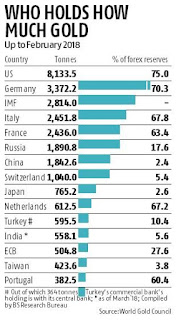

The big European holders – Italy and France – in the global gold reserve table which respectively report holdings of 2,451.8 tonnes and 2,436 tonnes.

China on the other hand has been constantly increasing its reserves but not reporting to the IMF. It’s expected to be in the sixth place, but it could be higher given that the numbers are not reported to. The current trade war between the US and China has propelled China to reduce its dependence on dollar holdings in its reserves and perhaps use that money to buy more gold, but yes, without reporting it to the IMF.

Chinese officials and academics have intimated in the past that they would like to at least reduce the dollar’s dominant position in world trade and as a global reserve currency. It is already taking measures towards this by negotiating oil and other contracts in Yuan (convertible into gold if wanted) rather than in dollars, which is another reason why it may be building its gold reserves as well.

As we have mentioned before gold may be facing short term headwinds, but longer term prospects look to be ever increasingly positive.

The sentiment shift is still subtle, but it’s both real and widespread. After a few years of being ignored and/or dismissed as basically useless and almost being disowned by investors, gold is stable again, attracting positive press and increasing accumulation by big investors.

Gold traded higher on Friday and is heading for the third straight weekly increase on the back of a rise of demand due to equity market volatility and a softer dollar. The market opened the day at 1229.70/1230.70. After the open, gold prices traded between a high level of 1230.46/1231.46

The gold in euro terms was trading at a three-month high near €1,070 per troy ounce. The conflict between Italy and the EU [European Union] over the Italian draft budget for 2019 is escalating.

The EU too seems to be taking a strong line against member states (Poland and Hungary are examples) which diverge politically from the consensus policies and rules. There is perhaps a fear here that the EU might break up if too many member states fall out with the EU hierarchy, which is probably why such a hard line is being taken on Brexit. A consensus deal is in both sides’ interests, but intransigence may well win the day, with adverse economic consequences for the U.K. and the EU as a whole.

Concerns that the euro-zone crisis could flare up again should support demand for gold as a safe haven.

Lately, US have been very aggressive in its trade policies and imposition of sanctions against countries like Russia and China. Indirectly the other counties that wish to trade with these sanctions hit economies will also suffer in the long run. They too will become victims of U.S. trade sanctions and imposed tariffs.

This is the main reason that countries like Russia and China have accelerated their gold reserves. Leading countries are trying to reduce dollar dependency, thus replacing it with gold.

The Russian central bank has announced yet another increase in its gold reserves in September – this time it has added a massive 1.2 million troy ounces (37.3 tonnes) to the gold in its Forex holdings. This brings the overall total to 65.5 million ounces (2,037.3 tonnes) and means it has added just short of 200 tonnes of gold to its reserves in the first 9 months of the current year which represents an increased acceleration in its reserve increases over the prior few years

The big European holders – Italy and France – in the global gold reserve table which respectively report holdings of 2,451.8 tonnes and 2,436 tonnes.

China on the other hand has been constantly increasing its reserves but not reporting to the IMF. It’s expected to be in the sixth place, but it could be higher given that the numbers are not reported to. The current trade war between the US and China has propelled China to reduce its dependence on dollar holdings in its reserves and perhaps use that money to buy more gold, but yes, without reporting it to the IMF.

Chinese officials and academics have intimated in the past that they would like to at least reduce the dollar’s dominant position in world trade and as a global reserve currency. It is already taking measures towards this by negotiating oil and other contracts in Yuan (convertible into gold if wanted) rather than in dollars, which is another reason why it may be building its gold reserves as well.

As we have mentioned before gold may be facing short term headwinds, but longer term prospects look to be ever increasingly positive.

The sentiment shift is still subtle, but it’s both real and widespread. After a few years of being ignored and/or dismissed as basically useless and almost being disowned by investors, gold is stable again, attracting positive press and increasing accumulation by big investors.