Gold and silver started off the week with little movement but coming Tuesday they both bounced back. The rally in bullion was inline with the rise in other commodities rates and U.S stock markets. Since the U.S markets were closed on Wednesday there was not much movement in the commodities markets.

SPOT MARKET gold prices traded close to $1610 an ounce for most of Tuesday morning in London, after breaking through the $1600 mark during the earlier Asian session. Silver prices touched $28 an ounce for the first time in nearly two weeks, while stocks and commodities also gained after disappointing US manufacturing data led to renewed speculation that the Federal Reserve might launch a third round of quantitative easing, known as QE3.

However, precious metals saw a decline post The Wednesday close.

Gold and silver prices declined following the ECB decision to cut interest rate by 0.25pp to 0.75% and deposit rates from 0.25% to zero. This news also adversely affected the Euro/USD. Moreover the growth in the US economy was seen at a much slower paceComex gold futures prices ended the U.S. day session modestly lower on Thursday in choppy trading. The sharply higher U.S. dollar index pressured the precious metals as did traders being in a bit of a “risk-off” mentality. Dollar`s rally of more than 1 percent on Thursday`s session, the biggest daily rise in nearly eight months. Unemployment claims reduced to 374K as compared to a forecast of 385K which showed positive signs in US job market though the Unemployment rate remained unchanged at 8.2%.

The wave of monetary decisions announced by major central banks sparked Fears in markets regarding the outlook for the global economy, which in turn triggered a sell-off in commodities and shares as investors resorted to safe haven assets, especially the U.S. dollar and yen.

In the physical market, demand is still lagging on lackluster buying from Asian countries. Bullion rates might continue to zigzag from gains to losses and basically move in the same direction as the major currencies pairs including Euro/USD.

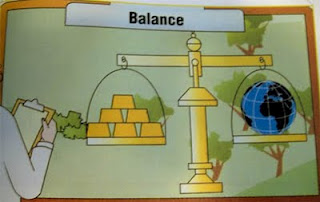

A stronger dollar can hurt demand for metals and other commodities by making them more expensive in other currencies. Further, a stronger dollar detracts from buying of gold as a sort of alternative currency, and vice-versa.